· Jane Iamias · vendor due diligence · 23 min read

What Is Vendor Due Diligence Explained

What is vendor due diligence? Learn how to properly assess vendor risk, protect your business, and ensure supply chain security with our step-by-step guide.

Think of vendor due diligence as doing your homework on a potential business partner before you sign on the dotted line. It’s a lot like getting a full survey done on a house before you buy it – you need to be sure there are no hidden cracks in the foundation that could cause major problems later on.

It’s More Than Just a Tick-Box Exercise

Let’s say you’re looking for a new cloud provider to store sensitive customer data. You wouldn’t just go with the cheapest option and cross your fingers, would you? Of course not. You’d want to look under the bonnet, checking out everything from their security protocols and financial stability to their compliance with regulations like GDPR.

That deep-dive investigation is precisely what vendor due diligence is. It’s a critical business practice designed to shield your organisation from a whole host of potential disasters. By properly vetting your suppliers, you protect yourself from:

- Financial Instability: What happens if your key software provider goes bust overnight? A financially unstable partner can cause massive disruption to your operations.

- Security Gaps: A vendor with poor cybersecurity is essentially a back door into your own network. Their vulnerability quickly becomes your breach.

- Reputational Damage: Your brand is judged by the company it keeps. Partnering with an unethical or unreliable vendor can do serious damage to your own reputation.

- Legal & Compliance Fines: If your supplier fails to meet regulatory standards like data protection laws, the legal responsibility—and the hefty fines—could easily fall on you.

A Powerful Business Advantage

Good due diligence isn’t just about dodging bullets; it’s about creating real, tangible value. In the UK M&A market, for example, companies that have their own house in order can see a huge upside. Proactive vendor due diligence has been shown to boost a company’s deal value by as much as 30% while cutting the transaction time in half. If you’re interested in the details, the experts at Azets explain how diligence directly impacts deal value.

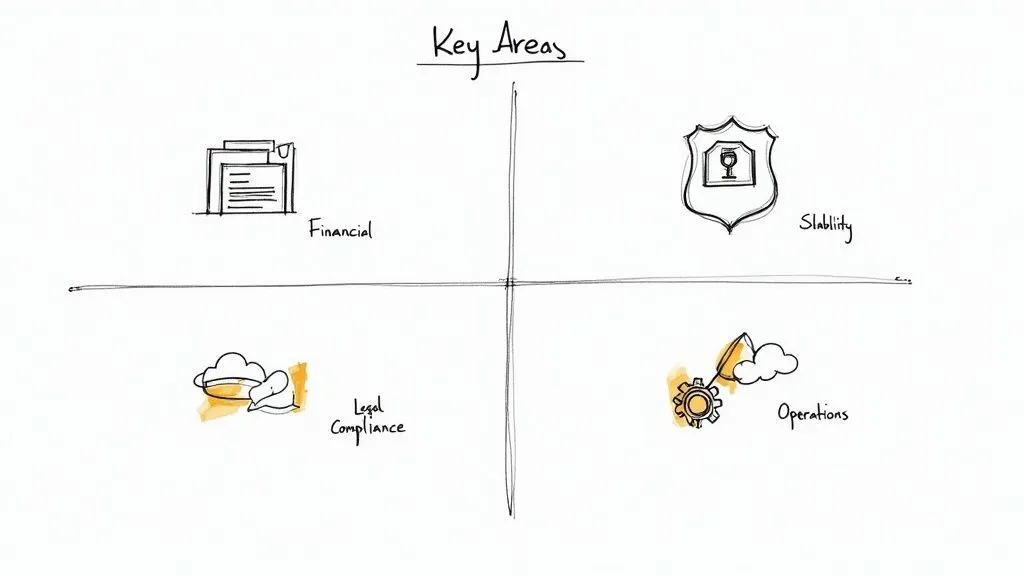

To give you a clearer picture, the entire process is built on a few core pillars. Each one addresses a different type of risk you need to be aware of.

Core Pillars of Vendor Due Diligence

| Pillar | Primary Focus | Example Question |

|---|---|---|

| Security | Assessing the vendor’s cybersecurity posture and data protection measures. | ”Can you provide your latest penetration test results and SOC 2 report?” |

| Privacy | Ensuring the vendor complies with data privacy laws like GDPR or CCPA. | ”How do you handle data subject access requests for our customers’ data?” |

| Legal & Compliance | Verifying regulatory adherence, licenses, and contractual obligations. | ”Are there any pending lawsuits or regulatory investigations against your company?” |

| Financial | Evaluating the vendor’s financial health and long-term viability. | ”Could you share your audited financial statements from the last two years?” |

| Operational | Confirming the vendor can reliably deliver the promised services. | ”What does your business continuity and disaster recovery plan look like?” |

These pillars form the foundation of a robust assessment, giving you a complete view of who you’re about to get into business with.

Vendor due diligence transforms risk management from a reactive scramble into a proactive strategy. It’s about making informed, evidence-based decisions that build a resilient, secure, and trustworthy supply chain for your business.

Ultimately, getting a firm handle on the risks associated with each vendor lets you make smarter partnership choices, negotiate stronger contracts, and build a much more resilient business. In today’s interconnected world, where your success depends on your partners, it’s a practice you simply can’t afford to skip.

Why Due Diligence Is Non-Negotiable Today

In a world where businesses are more connected than ever, your company’s security is only as strong as its weakest link. Skipping proper vendor due diligence is a bit like leaving a side door unlocked; it might seem fine for a while, but you’re inviting a whole host of risks right into your organisation. This isn’t just about ticking boxes anymore—it’s an essential function for survival and growth.

Failing to properly vet a partner can have disastrous, real-world consequences. Just imagine a critical software provider suddenly going out of business because of financial trouble. That could grind your operations to a halt overnight, leaving you scrambling for a replacement while your revenue and customer trust take a nosedive.

Then there’s the all-too-common third-party data breach. When hackers find a way into a vendor’s network, they can often use that access as a stepping stone directly into yours. The infamous 2013 Target data breach, which exposed the details of 40 million customers, all started with credentials stolen from one of its HVAC vendors. That single point of failure led to massive financial penalties and did irreversible damage to their reputation.

Protecting Your Reputation and Bottom Line

Your brand’s reputation is one of your most valuable assets, and it’s directly tied to the partners you bring on board. If you associate with a vendor involved in unethical practices or one that delivers a poor customer experience, that negativity can easily splash back onto you. Customers often don’t see the line between your company and your suppliers; to them, it’s all part of the same experience.

Beyond your good name, there are serious financial implications at stake. A solid vetting process helps you steer clear of partners who could quickly become a liability.

Due diligence isn’t an expense; it’s an investment in stability. It’s the proactive work that prevents reactive disasters, safeguarding your revenue, compliance status, and the trust you’ve worked so hard to build with your customers.

Meeting Modern Regulatory Demands

Compliance is another huge driver here. Regulations like the General Data Protection Regulation (GDPR) hold you directly accountable for how your vendors handle personal data. If your supplier isn’t compliant, it becomes your legal problem, and the fines can be eye-watering.

The UK’s regulatory environment has also ramped up the scrutiny on cybersecurity and third-party risk management. With cyber incidents on the rise, there’s a much greater emphasis on checking a vendor’s security controls, financial stability, and operational resilience. For instance, the introduction of regulations such as DORA and SEC has increased the need for robust vendor due diligence, especially for partners handling sensitive data.

Building a Resilient Supply Chain

Ultimately, rigorous due diligence is the foundation of a resilient business. The process ensures your partners are not only secure and compliant but also operationally sound and actually capable of delivering on their promises. This is a cornerstone of effective cybersecurity supply chain risk management, as it confirms that every single part of your operational ecosystem is dependable.

When you embed this practice into your procurement and partnership workflows, you create a stronger, more reliable network. This frees you up to innovate and grow with confidence, knowing your foundations are secure and your partners are genuine allies in your success. A thorough assessment is simply your best defence against the unpredictable nature of third-party relationships.

Key Areas of a Thorough Vendor Assessment

When your business’s reputation, security, and day-to-day operations are on the line, a quick, surface-level check just won’t cut it. A proper vendor assessment needs to dig deep into several distinct, yet interconnected, areas. Think of it like a multi-point inspection before buying a car; you wouldn’t just kick the tyres, you’d want to check the engine, the electronics, and the full service history to get the complete picture.

This comprehensive approach helps you build a 360-degree view of a potential partner. It’s about moving beyond box-ticking questionnaires to a more forensic analysis of their stability, security, and overall business health. Let’s break down the critical areas you need to scrutinise.

Financial Stability Analysis

Before you bake a vendor into your core operations, you need some confidence they’ll still be around next year. A partner’s financial collapse can cause massive disruption, leaving you scrambling to find a replacement while your own customer service takes a hit.

Evaluating a vendor’s financial health is all about gauging their long-term viability. This isn’t just for huge suppliers; even a small but critical software provider going bust can bring a team’s productivity to a screeching halt.

Key things to look into include:

- Financial Statements: Ask for their audited financial statements from the last 2-3 years. This lets you analyse their revenue, profit, and cash flow. You’re looking for consistent growth and healthy margins.

- Credit Reports: A business credit report can quickly reveal their payment history, any major debts, and red flags like bankruptcies or liens.

- Liabilities and Assets: A quick look at their balance sheet gives you a snapshot of their overall financial structure.

A financially sound partner is one you can build a lasting relationship with, without constantly worrying they might suddenly disappear.

Cybersecurity Posture Evaluation

In our hyper-connected world, your vendor’s weak security becomes your weak security. The moment you grant a third party access to your systems or data, you’re placing your trust in their cybersecurity defences. A breach on their end can very quickly become a full-blown incident for you.

Assessing their cybersecurity posture is, therefore, completely non-negotiable. It’s about getting proof that they have solid controls in place to protect sensitive information. You need to see evidence, not just take their word for it.

A vendor’s security certifications, like ISO 27001 or SOC 2, are more than just badges. They represent a real commitment to established security frameworks and provide third-party validation that their controls are designed and operating effectively.

To get a clear picture of their security, you should be asking for and reviewing:

- Security Certifications: Look for recognised standards like ISO 27001 for information security management or SOC 2 reports, which cover security, availability, and confidentiality.

- Penetration Test Results: Ask for a summary of their latest third-party penetration test. This shows they are proactively looking for weaknesses and fixing them.

- Incident Response Plan: What’s their game plan if a breach happens? A documented and tested incident response plan is a clear sign of maturity and preparedness.

This deep dive helps ensure you aren’t unknowingly opening a digital backdoor into your own organisation.

Legal and Regulatory Compliance Checks

Partnering with a non-compliant vendor can drag you into a world of legal and financial pain. Regulators increasingly hold companies accountable for the actions of their entire supply chain. If your vendor messes up and violates data protection laws like GDPR, for instance, your business could find itself on the hook.

This part of the assessment is all about making sure the vendor operates within the law and sticks to any industry-specific regulations that apply to you. It’s about protecting your organisation from inherited risk.

Your review should cover:

- Litigation History: A quick check for past or ongoing lawsuits can tell you a lot about potential operational problems or ethical issues.

- Regulatory Adherence: Verify they comply with the big ones relevant to your industry, whether that’s GDPR for data privacy, PCI DSS for payment processing, or HIPAA for healthcare.

- Licences and Permits: A simple but crucial check—do they hold all the necessary business licences to operate legally?

Compliance isn’t just a headache; it’s a fundamental part of risk management in modern business.

Operational Capability and Reputational Risk

Finally, you need to know two things: can they actually deliver on their promises, and will their public image tarnish your own? Operational capability is all about their ability to provide a reliable, consistent service, especially when things go wrong.

Reputational risk is just as important. Your brand is judged by the company it keeps. Partnering with a vendor caught up in public scandals or a storm of negative press can easily create a PR crisis for you by association. To make sure your due diligence is thorough, incorporating business analysis best practices is a smart move for any vendor assessment.

Key documents and checks here include:

- Business Continuity Plan (BCP): This document should outline how the vendor will keep essential functions running during and after a disaster. A weak or non-existent BCP is a massive red flag.

- Disaster Recovery (DR) Plan: This is more technical and details how they will recover their IT systems and data after a major outage.

- Adverse Media Scan: Do a search for negative news stories, persistent customer complaints, or social media controversy linked to the vendor.

- Customer References: Speaking directly with their existing customers offers invaluable, real-world insight into their performance and reliability.

By digging into these four key areas—financial, cybersecurity, legal, and operational—you give yourself the knowledge needed to make a smart, informed decision and build a resilient, trustworthy supply chain.

Vendor Assessment Checklist Example

To help you get started, here’s a practical checklist you can adapt. It summarises the key pieces of evidence you should be requesting across the different assessment areas. While not exhaustive, it covers the most critical documents that paint a clear picture of a vendor’s health and reliability.

| Assessment Area | Key Document/Evidence to Request | Purpose of Review |

|---|---|---|

| Financial | Audited Financial Statements (2-3 years), Business Credit Report | To confirm long-term viability, profitability, and responsible debt management. |

| Cybersecurity | SOC 2 Type II Report, ISO 27001 Certificate, Penetration Test Summary | To verify that robust security controls are in place and tested by independent third parties. |

| Legal/Compliance | Data Processing Agreement (DPA), Copies of Business Licences | To ensure adherence to data protection laws (like GDPR) and legal operating requirements. |

| Operational | Business Continuity Plan (BCP), Disaster Recovery (DR) Plan | To assess their preparedness for disruptions and their ability to maintain service continuity. |

| Reputation | List of Customer References, Public News/Media Scan Results | To gauge real-world performance and identify any potential brand-damaging associations. |

Using a structured checklist like this ensures you don’t miss any crucial steps. It provides a consistent framework for evaluating every potential partner, making your decisions more objective and defensible.

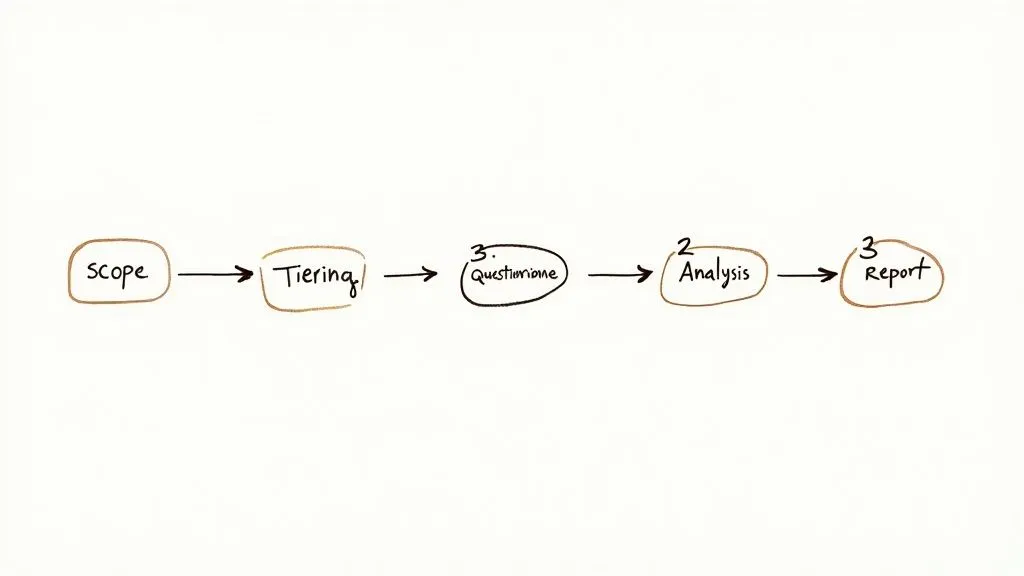

Your Step-by-Step Due Diligence Workflow

Trying to conduct vendor due diligence without a clear process is a recipe for disaster. It’s like trying to navigate a maze blindfolded – you might get there eventually, but it’s going to be messy, inefficient, and you’ll miss important things along the way. A structured workflow isn’t just about ticking boxes; it’s about turning a complex task into a manageable, repeatable system.

This kind of framework is what allows your team to stop making gut-feel decisions and start making objective, data-driven ones. Each stage, from the initial look to the final sign-off, has a specific job to do. Let’s walk through what a practical, real-world due diligence workflow actually looks like.

Stage 1: Scope the Review and Tier Your Vendors

Let’s be honest: not all vendors are created equal, so your due diligence shouldn’t be a one-size-fits-all affair. Spending weeks analysing your office coffee supplier is a waste of time, but a light touch on your new cloud infrastructure partner is just negligent. The first, most critical step is to apply a risk-based approach.

This is where vendor tiering comes in. It’s a simple concept: you categorise suppliers based on how critical they are to your business and the potential risk they introduce. A vendor that processes sensitive customer data is obviously high-risk, while one with zero data access and minimal operational impact is low-risk.

- Tier 1 (High-Risk): These are the vendors that need the full treatment. Think deep-dive security assessments, financial stability checks, and maybe even on-site audits.

- Tier 2 (Medium-Risk): This is your standard process. Detailed questionnaires and a thorough review of their evidence are usually enough.

- Tier 3 (Low-Risk): For these, a simplified, lightweight check to confirm basic compliance and stability is perfectly fine.

Tiering your vendors lets you focus your energy where it matters most, making the whole process smarter and more efficient. To really get to grips with this, have a look at our guide on how to conduct risk-based due diligence assessments on prospective vendors.

Stage 2: Gather Information and Request Evidence

Once you know how deep you need to dig, it’s time to start gathering information. This is where you collect the raw data for your analysis, primarily through security questionnaires and direct requests for documents.

The trick is to ask the right questions for the right tier. For a high-risk vendor, you’ll be sending an extensive questionnaire covering everything from their incident response plans to how they vet their employees. For a low-risk partner, a much shorter form focusing on the basics will do the job.

Crucial Tip: Never, ever just accept “yes” for an answer on a questionnaire. Always ask for the proof. If a vendor claims they have an ISO 27001 certification, ask to see the certificate. If they say they run annual penetration tests, you want to see a summary of that report.

This evidence-based approach is what separates what a vendor says from what they actually do.

Stage 3: Analyse Evidence and Score Risks

With all the documents and answers in hand, the real work begins. This is a team sport. Your subject matter experts from IT, legal, finance, and other departments need to get involved and review the evidence. The IT team will pour over the SOC 2 report, your legal eagles will scrutinise contracts and data processing agreements, and the finance team will analyse their financial health.

As you start spotting potential weaknesses or gaps, it’s a good idea to score them. A simple risk matrix works wonders here. You just plot the likelihood of a risk happening against its potential impact on your business. This simple act of scoring helps you prioritise, separating the minor admin issues from the show-stopping vulnerabilities.

Stage 4: Report Findings and Make a Decision

The final stage is all about communication. You need to pull all your findings together into a clear, concise due diligence report. The goal isn’t to drown your stakeholders in technical jargon but to give them the essential information they need to make a smart, informed decision.

Your report should summarise the process, highlight the key risks you’ve found (along with their scores), and end with a clear recommendation. It usually comes down to one of three outcomes:

- Approve: The vendor checks all the boxes. Go for it.

- Approve with Conditions: They’re a good fit, but you need to put specific security controls or contractual clauses in place to manage the risks you found.

- Reject: The red flags are just too big. The risk is too high to move forward.

This report is the final product of your entire workflow, creating a documented, defensible basis for your decision. To make this process stick, using a solid Standard Operating Procedure template can be invaluable for ensuring everyone follows the same steps, every single time.

How to Spot Red Flags and Score Vendor Risk

So, you’ve gathered all the documents and questionnaire answers. That’s the easy part. The real art of vendor due diligence is learning to read between the lines, connect the dots, and transform that mountain of raw data into a clear-eyed risk assessment. It’s like the difference between just collecting ingredients and actually knowing how to cook a brilliant meal.

A proper analysis takes you from a vague gut feeling to a decision backed by solid evidence. You need to train yourself to spot the subtle—and sometimes not-so-subtle—signs of trouble that might be buried in the information a vendor hands over. These red flags are your early warning system, signalling that a potential partnership could expose your business to unacceptable risk.

Common Red Flags to Watch For

Some warning signs will jump right off the page, but others are more cleverly disguised. A vendor might not tell you an outright lie, but they can be evasive, providing answers that are technically true but practically useless. Getting your team skilled at spotting these issues is a hallmark of a mature due diligence programme.

Keep an eye out for these tell-tale signs of trouble:

- Inconsistent Answers: This is a big one. If their questionnaire responses clash with their official documentation, something’s not right. For example, they might claim to have a robust incident response plan but then can’t actually produce the document when asked.

- Lack of Formal Policies: A vendor running without properly documented, board-approved policies for critical areas like security or business continuity is a sign of immaturity. It suggests their processes are probably just made up on the fly, which is a recipe for disaster.

- Evasive or Vague Responses: You ask for specific proof, like their latest penetration test results, and they send back a glossy marketing slick about their “state-of-the-art security.” This isn’t an answer; it’s a deflection.

- Poor Financial Health: Negative revenue trends, a scary debt-to-asset ratio, or a history of late payments flagged in credit checks are all clear signs of a financially unstable partner.

- Adverse Media Coverage: A trail of negative news stories, regulatory fines, or a string of unresolved customer complaints can point to deeper operational or ethical problems lurking beneath the surface.

Spotting these flags isn’t about instantly disqualifying a vendor. It’s about knowing which threads to pull to get a much clearer picture of the real risk involved.

Moving from Flags to a Formal Risk Score

Once you’ve flagged the potential issues, you need a consistent way to measure them. This is where risk scoring comes into play. It’s a simple but incredibly effective method for turning your qualitative observations into a quantitative score that anyone in the business can understand. A structured approach like this stops personal bias from clouding your judgement and helps you focus on the biggest threats first.

Risk scoring isn’t about getting lost in complex algorithms. It’s about systematically evaluating the likelihood of something going wrong against the potential impact it would have on your business. This simple framework brings much-needed clarity to complex decisions.

A common and highly effective tool for this is the impact versus likelihood matrix. You simply assess each risk you’ve identified on these two scales.

- Likelihood: How probable is it that this weakness will be exploited or cause an issue? (e.g., Very Unlikely, Possible, Very Likely)

- Impact: If it does happen, how severe would the fallout be for your business? (e.g., Low, Medium, Critical)

Let’s take an example. A vendor with no disaster recovery plan (likelihood: possible) that provides a mission-critical service to you (impact: critical) would instantly register as a high-priority risk. This straightforward scoring system makes it easy to see which problems demand immediate attention and which are minor niggles, allowing you to make a confident, evidence-based decision about the partnership.

Streamlining Your Process with Modern Tools

As your business grows, so does your vendor list. Before you know it, trying to manage due diligence with spreadsheets and endless email chains becomes a serious drag on your team’s productivity. It’s a familiar story: chasing vendors for questionnaires, tracking down evidence, and piecing together an audit trail turns into a full-time job.

This manual approach isn’t just slow; it’s genuinely risky. Important details get lost in cluttered inboxes, and follow-ups are easily missed. Relying on outdated methods means your team is bogged down in admin instead of focusing on the high-level analysis that actually protects your business.

This is where dedicated vendor risk management platforms completely change the game. They help you move from a clunky, one-off checklist exercise to a living, breathing risk management programme.

The Power of Automation and Centralisation

At their core, these tools are built to kill the administrative busywork and bring some much-needed order to your workflow. They give you a smarter way to manage the entire due diligence lifecycle.

A few game-changing features usually include:

- Automated Questionnaires: Forget emailing spreadsheets back and forth. You can send, track, and manage all your security questionnaires from one central hub.

- Centralised Evidence Collection: Every piece of vendor documentation, from SOC 2 reports to insurance certificates, lives in a single, secure, and searchable place.

- Continuous Monitoring: Many platforms plug into services that constantly scan for new threats, giving you a heads-up on emerging risks without you having to lift a finger.

This dashboard from ResponseHub is a great example of how a modern platform centralises knowledge and takes the pain out of managing security questionnaires.

By organising everything in one place, it becomes incredibly simple for teams to find verified answers and keep the due diligence process moving smoothly.

By shifting to a purpose-built tool, you free up your team to focus on what truly matters: analysing high-risk issues and making informed decisions, rather than getting bogged down in endless follow-ups and document management.

Ultimately, these tools help you build a due diligence programme that’s more effective and can scale as you grow. For example, platforms offering security questionnaire automation can slash the time it takes to complete and review vendor assessments, all while improving consistency. This frees your team to handle an expanding list of vendors without ever having to cut corners on risk assessment, building a much more resilient foundation for your business.

Vendor Due Diligence: Your Questions Answered

As you start to build out your own due diligence process, a few common questions always seem to pop up. Let’s tackle some of the most frequent ones I hear from teams just getting started.

How Often Should We Re-Assess Our Vendors?

There’s no single right answer here—it all comes down to risk. Think about your most critical partners, the ones handling sensitive customer data or core business functions. These high-risk vendors need a thorough review at least annually, and you should also reassess them any time they make a major change to their services.

For your lower-risk suppliers, you can probably stretch that out to a full review every 24 to 36 months. A smart strategy is to combine these deep-dive assessments with some form of continuous monitoring. This helps you catch any red flags that might appear between your scheduled reviews.

What’s the Real Difference Between Due Diligence and Vendor Risk Management?

It’s easy to get these two mixed up, but the distinction is pretty simple.

Think of vendor due diligence as the rigorous background check you perform before signing a contract. It’s that initial, deep investigation to make sure a potential partner is a good fit and to get a clear picture of any risks they might introduce.

Vendor Risk Management (VRM), on the other hand, is the whole relationship from start to finish. It starts with due diligence but continues with ongoing monitoring, performance tracking, and eventually, the process of offboarding them securely. Due diligence is the essential first step in a much bigger VRM picture.

Due diligence is a point-in-time assessment before a contract is signed. Vendor Risk Management is the continuous process of managing that partner’s risk throughout the entire business relationship.

Do We Really Need to Do This If We’re a Small Business?

Yes, absolutely. In fact, a small business can be hit even harder by a vendor-related data breach or service outage. The financial and reputational damage can be devastating when you don’t have the resources of a large enterprise.

Of course, your process doesn’t need to be as complex as a multinational corporation’s. You can scale it to fit. Maybe that means using a lighter questionnaire for low-risk vendors or focusing only on your most critical suppliers. The key is to have a process, because skipping it altogether means you’re flying blind—accepting risks you don’t even know exist.