· Jane Iamias · Due Diligence Questionnaire · 19 min read

what is a due diligence questionnaire? Essential guide

what is a due diligence questionnaire? Discover its purpose, essential components, and effective response tips for smoother UK deals.

Ever wondered what goes on behind the scenes before a major business deal? Think of a Due Diligence Questionnaire (DDQ) as the deep-dive investigation that happens before any contracts are signed. It’s a formal set of questions one company sends to another to get a clear picture of what they’re really getting into, whether it’s a merger, an investment, or a new supplier partnership.

This isn’t just about ticking boxes; it’s a fundamental part of managing risk.

What Is a Due Diligence Questionnaire Anyway?

At its heart, a DDQ is a structured fact-finding mission. It provides a formal framework for one organisation to systematically gather and review crucial information from another. It’s a bit like a diagnostic tool, designed to give a full health check on a potential partner’s financial, legal, operational, and even reputational standing.

To really get your head around it, it helps to understand what due diligence entails as a whole concept. The questionnaire is simply the main tool used to conduct that investigation, creating a methodical way to ask for and receive the proof you need.

Beyond the Basics of a DDQ

Let’s say you’re looking to invest in a promising tech startup. You wouldn’t just take their word for it that their finances are in order and their software is secure. Instead, you’d send them a detailed DDQ asking pointed questions about their balance sheets, who owns the intellectual property, and how they protect customer data.

Their answers, backed up with actual documents, paint a realistic picture and help you see where the real risks lie.

Here in the UK, the process is often guided by specific regulations. A DDQ in the financial services world, for instance, will be packed with questions about compliance with the Financial Conduct Authority (FCA). Likewise, any company that handles personal data will be grilled on how well they stick to the rules set by the Information Commissioner’s Office (ICO) and GDPR.

A well-crafted DDQ cuts through the noise and ambiguity. It replaces assumptions with hard facts, building a transparent and trustworthy foundation for any major business move and protecting you from nasty surprises down the line.

The Modern DDQ in Practice

These questionnaires aren’t getting any simpler. In fact, they’re becoming more complex, driven by ever-changing regulations and market dynamics in the UK. With global M&A deal openings climbing by 12% year-on-year, the pressure for comprehensive and efficient due diligence has never been greater.

This is why many firms are now turning to sophisticated tools and AI to handle the sheer volume and intricacy of modern DDQs.

To put it simply, a DDQ is designed to perform several essential tasks. The table below breaks down its core functions.

Core Functions of a Due Diligence Questionnaire

| Function | Objective and UK Context |

|---|---|

| Risk Identification | To uncover potential red flags, from shaky finances and legal disputes to data security gaps. In the UK, this includes checking for compliance with the Bribery Act or Modern Slavery Act. |

| Verification of Claims | To make sure the information a potential partner presents is accurate and can be proven with evidence. It’s about separating the sales pitch from reality. |

| Informed Decision-Making | To equip stakeholders with the concrete data needed to approve, reject, or renegotiate the terms of a transaction. |

| Compliance & Governance | To create a clear, auditable trail demonstrating that thorough checks were completed before committing to a partnership. This is crucial for satisfying board members and regulators. |

Ultimately, the DDQ is your organisation’s first line of defence, ensuring that every new relationship is built on a solid, well-understood foundation.

Understanding Who Sends DDQs and Why

A due diligence questionnaire isn’t a one-size-fits-all document. Its purpose and focus shift dramatically depending on who’s asking the questions and, more importantly, why they’re asking. The sender’s motivations directly shape the entire line of questioning, which means your company could receive wildly different DDQs for different reasons.

Think of it this way: the DDQ from a potential investor will have a completely different feel to one from a new enterprise customer. The investor is all about risk versus reward. They’re digging into your growth projections, trying to validate your market position, and poring over your financials to make sure they’ll see a solid return on their investment. Their focus is squarely on the future.

Different Issuers, Different Priorities

On the other hand, when a large corporation sends a DDQ to a potential new supplier, the priorities flip. Now, the main concern is mitigating risk—operational, security, and even reputational. The buyer needs rock-solid assurance that you, the new vendor, won’t introduce a vulnerability into their systems or create a weak link in their supply chain.

This is especially true for vendor partnerships, where the scrutiny can be intense. We cover this in more detail in our guide on what vendor due diligence entails. In these cases, the questions will dive deep into things like data security protocols, compliance with regulations like GDPR, and even your ethical sourcing practices.

The core takeaway is this: the issuer’s goal dictates the questionnaire’s content. An investor is buying into your future; a corporate partner is protecting their present.

Here’s a look at the most common players who issue DDQs and what they’re typically looking for:

Private Equity and Venture Capital Firms: It’s all about financial validation for them. They are laser-focused on your growth potential, profitability, market share, and the strength of your leadership team. They want to see the numbers that back up the story.

Corporate Acquirers (M&A): Their goal is a smooth and successful integration. Questions will centre on operational compatibility, hidden legal liabilities, who owns the intellectual property, and whether the two company cultures can actually merge without chaos.

Large Enterprise Customers: For them, it’s purely about risk management. They need to know about your data security, your compliance with standards like ISO 27001, your business continuity plans, and how you manage risk with your own suppliers.

Lenders and Banks: They’re assessing your creditworthiness. Plain and simple. Their DDQ will probe your financial stability, existing debt, cash flow, and the quality of any assets you could offer as collateral.

Getting a handle on these different motivations is the first step to crafting a powerful response. It lets you get ahead of their concerns and frame your answers in a way that builds trust from the get-go.

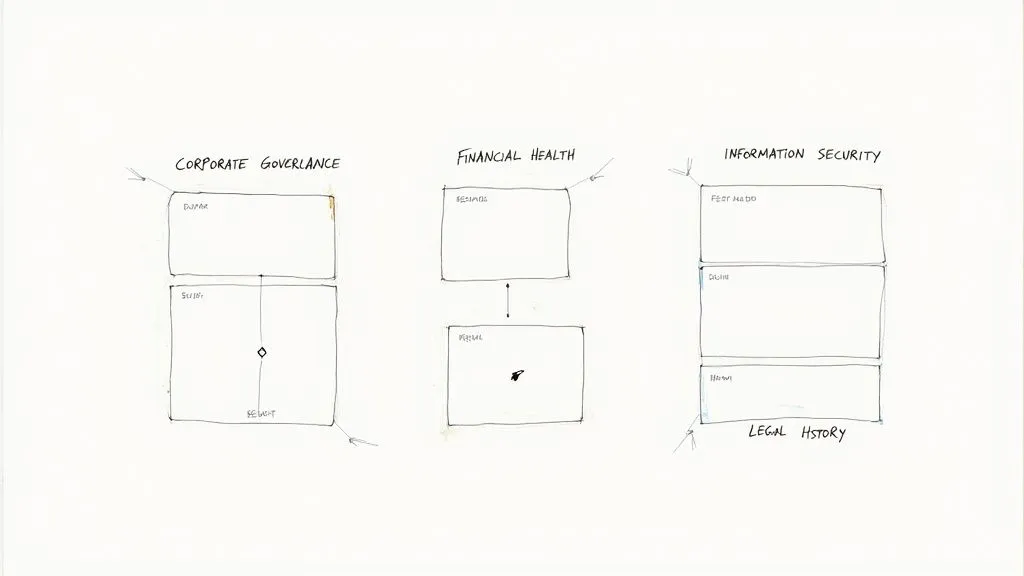

Breaking Down the Key Sections of a DDQ

Cracking open a DDQ for the first time can feel a bit like being handed a 500-page legal document. It’s an intimidating wall of questions. But here’s the secret: it isn’t just a random list of queries. A well-constructed DDQ is a highly organised document, broken down into logical sections designed to probe specific areas of your business.

Think of it like a mechanic giving a car a thorough MOT. They don’t just ask, “Is it roadworthy?” They methodically check the engine, the brakes, the electrics, and the chassis. In the same way, a DDQ examines your corporate governance, financial stability, and operational resilience one focused section at a time. Once you grasp this structure, the whole process becomes far less daunting.

While the exact layout can vary, most DDQs follow a similar pattern, homing in on the most critical aspects of a business relationship. Let’s walk through some of the most common sections you’re almost certain to encounter.

Common DDQ Sections and Sample Questions

Here is a quick breakdown of the typical sections you’ll find in a due diligence questionnaire, along with the kind of questions they’re designed to answer.

| Section | Focus Area | Sample Question Example |

|---|---|---|

| Corporate Governance | The company’s structure, leadership, and ethical framework. | ”Please provide your articles of incorporation and a list of all current board members and their professional backgrounds.” |

| Financial Health | Proof of solvency, financial management practices, and liabilities. | ”Please supply audited financial statements for the past three fiscal years, including balance sheets and profit & loss statements.” |

| Information Security | Policies and controls for protecting data and systems from cyber threats. | ”Do you maintain a formal information security programme that is aligned with a recognised framework (e.g., ISO 27001, SOC 2)?” |

| Legal & Compliance | Adherence to laws, regulations, and details of any ongoing litigation. | ”Are there any pending, or threatened, legal proceedings against the company? If so, please provide details.” |

| Operational Resilience | Business continuity and disaster recovery plans. | ”Please provide a copy of your Business Continuity Plan (BCP) and the date it was last tested.” |

| ESG Policies | Environmental, Social, and Governance commitments and practices. | ”Describe your company’s policies regarding environmental impact and supply chain ethics.” |

Understanding the ‘why’ behind each of these sections is the key to providing answers that not only tick the box but also build confidence and trust with your potential partner.

A Deeper Look at Key Sections

Corporate Governance and Structure

This is usually the first stop. The organisation asking the questions needs to know who’s in charge, how your company is legally structured, and what rules govern its operation. It’s all about confirming you’re a legitimate, well-run business with credible people at the helm.

You should be ready to provide details on your company structure, including ownership information and articles of incorporation. They’ll also want to know about your board members, key executives, and the internal policies—like codes of conduct or anti-bribery procedures—that guide your team.

Financial Health and Stability

Whether it’s for an investment, an acquisition, or a simple vendor partnership, your financial stability is non-negotiable. This section is a financial deep dive to verify that your company is solvent, managed sensibly, and not hiding any nasty surprises.

Expect requests for audited financial statements, tax documents, and details on any existing loans or significant debts. It’s a look under the financial bonnet to make sure you’re a viable long-term partner.

The goal here is transparency. A potential partner needs assurance that you won’t become a financial liability down the line. Having clear, well-documented financial records ready to go is one of the fastest ways to build trust.

Information Security and Cybersecurity

In a world that runs on data, this section has ballooned in importance and length. When another organisation partners with you, they are effectively taking on your cyber risk. With research showing that a staggering 62% of network intrusions can be traced back to a third party, it’s no wonder this area gets so much attention.

This part of the DDQ will rigorously test your security posture. You’ll be asked about compliance with security frameworks like ISO 27001 or SOC 2, your documented plan for handling a data breach, and how you protect data in line with regulations like GDPR. It’s about proving you can be trusted to keep sensitive information safe.

The Rise of ESG in UK Due Diligence

Due diligence used to be all about the numbers on a balance sheet. Not anymore. In the UK, a company’s long-term health is now judged just as much by its commitment to Environmental, Social, and Governance (ESG) principles as it is by its financial performance. This isn’t a passing trend; it’s become a non-negotiable part of any serious risk assessment.

Frankly, a due diligence questionnaire today isn’t worth the paper it’s printed on without a section dedicated to ESG. With investors demanding more and regulators piling on the pressure, how a company handles sustainability, ethics, and corporate behaviour is now under a microscope. It’s no longer a ‘nice to have’—it’s a core indicator of reputational risk and future staying power.

What Does ESG Look Like in a DDQ?

When a DDQ starts asking about ESG, it’s a sign the conversation has shifted from purely financial metrics to questions about values and real-world impact. The goal is to get a clear picture of how an organisation interacts with the world around it, from its carbon footprint right down to its internal company culture. This is where you uncover potential liabilities that a traditional financial audit would almost certainly miss.

In UK mergers and acquisitions, for example, ESG has become a major focus. Companies are now being scrutinised on everything from voluntary ethnicity pay gap reporting to their broader commitment to diversity and inclusion. It’s also common for buyers to expect the company they’ve invested in to uphold and report on ESG standards within the first 90 days as part of post-deal planning. You can read more about these HR and ESG trends in M&A.

This focus boils down to very specific lines of questioning, usually organised around three core pillars:

Environmental: This is all about a company’s direct impact on the planet. Expect questions on energy consumption, waste management policies, carbon emissions reporting, and whether the supply chain follows sustainable practices.

Social: This pillar digs into how a company manages its relationships with its people, its customers, and the communities it operates in. Questions will cover employee health and safety, diversity and inclusion policies, data privacy, and ethical labour standards.

Governance: Governance is about how a company runs its own house. This section probes the board structure, executive pay, internal controls, shareholder rights, and policies on bribery and corruption. It essentially asks: is this business run in an ethical and transparent way?

ESG is no longer a fringe issue; it is a tangible measure of a company’s operational integrity and its ability to succeed in a market that values responsibility. A poor performance on ESG questions can be a serious red flag, potentially derailing a deal or partnership entirely.

In today’s business climate, ignoring ESG is like ignoring your profit and loss statement. It offers a crucial, forward-looking view of a company’s health. Seeing it in a DDQ is a clear signal that potential partners are looking for more than just profit—they’re looking for sustainable, responsible growth.

How to Respond to a DDQ Effectively

When a due diligence questionnaire lands on your desk, it’s more than just a form to fill out. It’s your chance to make a great first impression, building trust and showing just how professional your organisation is. A slick, well-managed response process shows competence and transparency, turning what feels like a major chore into a real business advantage.

The secret is to treat it like a project, not a Q&A session. This means it needs a clear owner, a solid team, and a focus on getting the details right. The very first step? Appoint a single point of contact or a project manager to run the show. This person will coordinate everything, keep an eye on progress, and make sure the final submission speaks with one clear voice. Trying to tackle a DDQ by committee without a leader is a fast track to chaos, missed deadlines, and contradictory answers.

Assembling Your Response Team

Let’s be realistic: no one person has all the answers. Pulling together a strong response requires a crack team of subject matter experts from across the business. Your core team will almost always need people from:

- Legal and Compliance: They’ll handle all the tricky questions about corporate structure, any ongoing litigation, and how you stick to the rules.

- Finance: The go-to experts for financial statements, tax records, and proof that the company is on solid ground.

- IT and Security: They’re essential for answering the technical deep-dive questions on cybersecurity, how you protect data, and your plans for dealing with incidents. Our data protection policy templates, for instance, can provide a solid starting point for their documentation.

- Human Resources: They’ll cover everything related to employee policies, staff training, and the company culture.

Getting the right people involved from the start means every question gets answered by the person who knows it best, which dramatically boosts the quality and accuracy of your submission.

Establishing a Single Source of Truth

One of the biggest time-sinks when responding to a DDQ is the frantic hunt for information. You know the drill—chasing down documents and answers scattered across different departments, servers, and inboxes. A centralised knowledge base, your ‘single source of truth’, is the solution. This is where you store pre-approved answers to common questions, backed up with the latest policy documents and evidence.

Responding to a DDQ effectively is about more than just accuracy; it’s about demonstrating organisational maturity. A swift, well-documented, and honest response signals that your company is a reliable and low-risk partner.

This push for consistency isn’t just happening within companies. In the UK, organisations like the Association of Research Managers and Administrators (ARMA) have created standardised questionnaires to make due diligence simpler for university research partnerships. It’s a great example of reducing the admin headache for everyone.

At the end of the day, honesty is everything. If you have a weakness, it’s far better to be upfront about it and explain how you’re managing the risk. A transparent answer, even if it’s not perfect, builds far more trust than a flawless-sounding response that bends the truth.

Streamlining Your DDQ Process with Technology

If you’ve ever felt the drain of answering the same due diligence questions over and over, you’re not alone. It’s a huge resource sink. This constant, manual grind keeps your most valuable experts bogged down in admin instead of driving the business forward. The smart move is to stop being reactive and start using technology to get ahead of the game.

The first step is building a centralised knowledge base. Just think of it as your company’s ‘answer library’—a single, trusted source for pre-approved answers to all the common questions you face. This simple change ensures every response that goes out the door is consistent, accurate, and up to date.

The Power of a Centralised Knowledge Base

Once that library is in place, the real magic starts. Modern software can plug directly into your knowledge base, completely changing how you handle DDQs. Instead of your team digging through old documents for answers, the right tool can automatically fill out huge portions of a new questionnaire in minutes.

This unlocks some serious advantages:

- Faster Turnarounds: You can slash the time it takes to get a completed DDQ back to the requester.

- Greater Accuracy: Pulling from a single, approved source gets rid of guesswork and stops contradictory answers from slipping through.

- Clear Audit Trails: You get a clean, transparent record of every question asked and the exact answer provided.

It’s a perfect example of the wider benefits of business process automation, turning a painful chore into a slick, well-managed operation.

From Manual Effort to Competitive Edge

The best platforms even help you get started. You can often import past questionnaires to build your initial knowledge base or create one from scratch based on respected frameworks like NIST CSF 2.0. From there, smart systems can use AI to suggest updates as new DDQs are completed, so your answer library is always current with minimal effort.

By adopting automation, you convert your DDQ process from a simple compliance hurdle into a genuine competitive advantage. Faster, more accurate responses demonstrate professionalism and build trust with potential partners and customers from the outset.

Tools that provide security questionnaire automation make this kind of efficiency easier than ever to achieve. They offer features like clear source citations for every auto-filled answer, smooth handling of complex spreadsheets, and collaborative workflows that let your whole team manage the process without breaking a sweat.

Answering Your Top Questions About Due Diligence Questionnaires

Even once you get your head around the concept of a DDQ, some very practical questions always seem to pop up when you’re in the thick of it. Let’s tackle some of the most common queries to help you sidestep any potential snags.

How Long Does It Take to Complete a DDQ?

This is a classic “how long is a piece of string?” question. The time it takes to get a DDQ over the finish line can vary wildly. A simple vendor questionnaire might be wrapped up in a couple of days, but a deep-dive DDQ for a major merger could easily soak up several weeks of your team’s time.

Ultimately, the timeline hinges on a few key things:

- The sheer volume of questions and the depth of detail required.

- How ready your organisation is – is the information you need buried in spreadsheets or instantly accessible?

- The diary availability of your subject matter experts who need to sign off on the answers.

There’s no doubt that having a central knowledge base is the best way to accelerate the process. It’s not uncommon to see response times shrink from weeks down to a matter of days.

How Should We Handle Difficult Questions?

What do you do when a question stumps you, or worse, forces you to admit to a problem? The golden rule here is simple: be transparent.

If you genuinely can’t answer something, just explain why. Perhaps you don’t track the specific data point they’re asking for, or maybe the question just doesn’t apply to how your business works. It’s a perfectly reasonable response.

And if you have to disclose something negative, like a past data breach or some ongoing legal issue, the best approach is to be upfront and honest. Don’t just drop the bad news and run. Frame the issue by explaining what you’ve done to fix it, what controls you’ve put in place, and how you’re preventing it from ever happening again.

An honest, proactive disclosure almost always lands better with assessors than trying to sweep a problem under the carpet. It shows integrity and a mature, responsible approach to managing risk.

Is It Okay to Reuse Answers from Old DDQs?

Absolutely. Reusing answers from previous questionnaires isn’t just acceptable; it’s a smart, efficient way to work. This is precisely why building up an answer library or using a proper knowledge base is such a game-changer.

But—and this is a big but—you have to do it carefully. Before you just copy and paste an old response, you need to be certain the information is still 100% accurate and that it properly answers the new question. Things change. Policies get updated, procedures evolve, and data goes out of date. Always give reused content a thorough review and tweak it so it’s a perfect fit for the current questionnaire.