· Jane Iamias · due diligence questionnaire meaning · 12 min read

What Is a Due Diligence Questionnaire Meaning a Guide for Businesses

Discover the due diligence questionnaire meaning and its crucial role in risk management. Learn how to navigate the DDQ process with expert tips and examples.

Before jumping into any major business deal, you need to look under the bonnet. That’s precisely what a due diligence questionnaire (DDQ) is for. It’s a formal, structured list of questions a company uses to investigate a potential partner, supplier, or investment target before signing on the dotted line.

Think of it as a deep-dive background check for a business, designed to uncover any hidden risks and make sure everything they’ve claimed is actually true.

What Does a Due Diligence Questionnaire Actually Mean?

Let’s put it this way: you wouldn’t buy a house just because the brochure looks nice. You’d hire a professional surveyor to check for dodgy wiring, hidden damp, or problems with the foundations. A DDQ does the exact same job, but for high-stakes business decisions.

It’s the tool of choice in several critical scenarios:

- Mergers and Acquisitions (M&A): The acquiring company will send a DDQ to dig into the target company’s finances, legal history, and operational setup to make sure they know exactly what they’re buying.

- Vendor Partnerships: Before you rely on a new software provider or a key supplier, a DDQ helps you vet their security practices, data privacy compliance, and overall reliability.

- Venture Capital Investments: Investors use DDQs to grill startups on everything from their market projections and who owns the intellectual property to the track record of the founders.

At its heart, a DDQ is all about replacing assumptions with hard evidence. It’s a systematic way to get the facts, giving you the confidence to make an informed decision without worrying about nasty surprises down the road.

To boil it all down, here’s a quick snapshot of what a DDQ is all about.

The Due Diligence Questionnaire at a Glance

| Aspect | Description |

|---|---|

| Primary Purpose | To systematically gather and verify crucial business information for risk assessment. |

| Key Objective | To identify potential liabilities, validate financial and operational claims, and ensure compliance. |

| Common Users | Investors, acquiring companies, legal teams, financial analysts, and procurement departments. |

This process is fundamental to building trust and ensuring that a potential partnership is as solid as it appears on the surface.

Why the DDQ Is More Than Just Paperwork

https://www.youtube.com/embed/UajAhvy2qsw

It’s easy to dismiss a due diligence questionnaire as just another bureaucratic hoop to jump through. But that’s a huge mistake. In reality, a DDQ is one of the most powerful risk management tools your business has. Think of it as the foundational research that shields you from hidden dangers when you’re about to make a big move, like a partnership, acquisition, or major investment.

This isn’t about ticking boxes for the sake of it. It’s a structured investigation designed to uncover potential threats before they can do any real damage. The DDQ is your mechanism for spotting and sizing up all kinds of risks.

A Shield Against Critical Business Risks

A well-handled DDQ process is your first line of defence against threats that could otherwise fly completely under the radar. Without this deep dive, a company leaves itself wide open to some serious vulnerabilities.

These risks typically fall into a few key buckets:

- Financial Instability: Are there undisclosed debts lurking? Is cash flow weaker than it looks? Are the financial projections built on hope rather than reality?

- Operational Failures: You might uncover clunky, inefficient processes, a dangerous over-reliance on one or two key people, or a total inability to scale up.

- Legal & Compliance Troubles: This is where you find out about pending lawsuits, regulatory fines, or failures to comply with UK laws that could come back to bite you.

- Cybersecurity Threats: A DDQ can expose shoddy data protection habits or a history of security breaches that weren’t publicly disclosed.

Failing to dig into these areas can lead to absolute disaster. In fact, a report found that a staggering 76% of failed mergers and acquisitions were a direct result of problems discovered too late in the game or an inadequate due diligence process. Discover more insights on due diligence strategy at magistralconsulting.com.

The whole point of a DDQ is to create transparency and accountability. It forces a potential partner to back up their claims with hard evidence, giving you the verified data you need to either sign the deal with confidence or wisely walk away.

Ultimately, getting to grips with what a DDQ truly means is recognising its strategic importance. It’s not paperwork—it’s the essential investigation that protects your company’s future by preventing costly errors and ensuring you only team up with businesses that are as solid as they say they are.

Anatomy of a Due Diligence Questionnaire

A good due diligence questionnaire isn’t just a jumble of nosy questions. It’s a carefully structured investigation, with each section designed to tell a specific part of a company’s story. When you understand its anatomy, you can appreciate the logic behind the questions and see how they build a complete picture of a business’s health.

Think of it like a full-body medical scan for a company. Each part of the questionnaire examines a different vital system, checking for weaknesses, pre-existing conditions, and overall fitness. Together, these sections give the inquiring party a holistic view, uncovering everything from financial stability to hidden legal risks.

Core Investigative Areas

While the specifics can vary, most DDQs are built around a few core pillars. These categories are designed to probe the most critical aspects of a business, making sure no stone is left unturned.

- Financial Health: This is the bedrock. Questions here dig into historical performance, revenue streams, debt, and cash flow. The goal is to figure out if the company is financially sound or built on shaky ground.

- Legal and Compliance: Think of this section as a legal X-ray, searching for past, present, or potential liabilities. It covers everything from pending lawsuits and regulatory compliance to intellectual property rights and contractual commitments.

- Operations and Management: Here, the focus shifts to the people and processes that make the business tick. Questions will assess the strength of the management team, the state of employee relations, and how efficient the day-to-day workflows really are.

- IT and Cybersecurity: In our digital-first world, this part is absolutely non-negotiable. It scrutinises a company’s digital defences, data privacy policies, and its ability to withstand cyber threats. Essentially, it reveals how well they protect their information—and yours.

The Rise of ESG Criteria

Lately, a fifth pillar has become just as important, reflecting a major shift in how we measure business value beyond pure profit.

Environmental, Social, and Governance (ESG) criteria are now a standard feature in many modern DDQs. This section investigates a company’s environmental footprint, its commitment to social responsibility, and the integrity of its corporate governance. It’s a direct response to the growing demand for ethical and sustainable business practices.

Each of these sections works in concert to give the due diligence process its true meaning. For a deeper dive into how to structure these checks, our guide provides a detailed due diligence checklist covering these core areas and more. Understanding this framework helps you anticipate what’s coming and prepare thoughtful, accurate answers.

Understanding Who Is on Each Side of the Table

Think of a due diligence questionnaire as a structured conversation rather than a one-way interrogation. To really get a handle on the process, it helps to know who’s sitting on each side of the table.

First, you have the issuer. This is the party taking on the risk—an investor sizing up a new opportunity, or a company looking to acquire another business. They’re the ones who write and send out the DDQ because they need a deep, honest look at what they’re potentially getting into.

On the other side, you have the responder. This is the company under the microscope, whether it’s a startup seeking funding or a business being considered for a partnership. For them, filling out the DDQ is a serious undertaking. It’s a real all-hands-on-deck effort, roping in specialists from finance, legal, HR, and IT to pull together accurate and verified answers.

Who Completes and Reviews the DDQ

Once the answers are submitted, a specialised team from the issuer’s side gets to work, meticulously picking apart every detail. This review team is usually made up of:

- Legal Counsel: They’re on the lookout for any compliance red flags or hidden risks in contracts.

- Financial Analysts: Their job is to pore over the numbers, validating the company’s financial health and future projections.

- Technical Experts: These specialists assess everything from IT infrastructure and security protocols to operational capabilities.

This kind of structured review is now common practice across the UK. The Association of Research Managers and Administrators (ARMA), for example, even introduced a revised DDQ to make the process more consistent for research collaborations. It just goes to show how vital this process is for maintaining clear standards.

The key takeaway is that having the right experts on both sides is non-negotiable. It ensures the entire conversation is grounded in facts, which leads to a much smarter assessment and helps everyone avoid nasty surprises down the line.

Whether you’re vetting a new supplier for developing a comprehensive marketing strategy or gearing up for a major acquisition, our guide on vendor due diligence provides practical steps to help you navigate the process from start to finish.

How Modern Tools Are Changing the DDQ Game

Anyone who’s manually completed a detailed due diligence questionnaire knows the grind. It’s a slow, repetitive marathon of digging through old documents and chasing down the same experts for answers they’ve given a dozen times before. Frankly, it’s a colossal drain on time and talent.

Thankfully, the days of wrestling with sprawling spreadsheets are numbered. New technology is completely reshaping how businesses tackle DDQs, turning a painful, reactive chore into a smart, strategic operation. The focus is shifting towards intelligent platforms designed to automate responses and centralise a company’s collective knowledge.

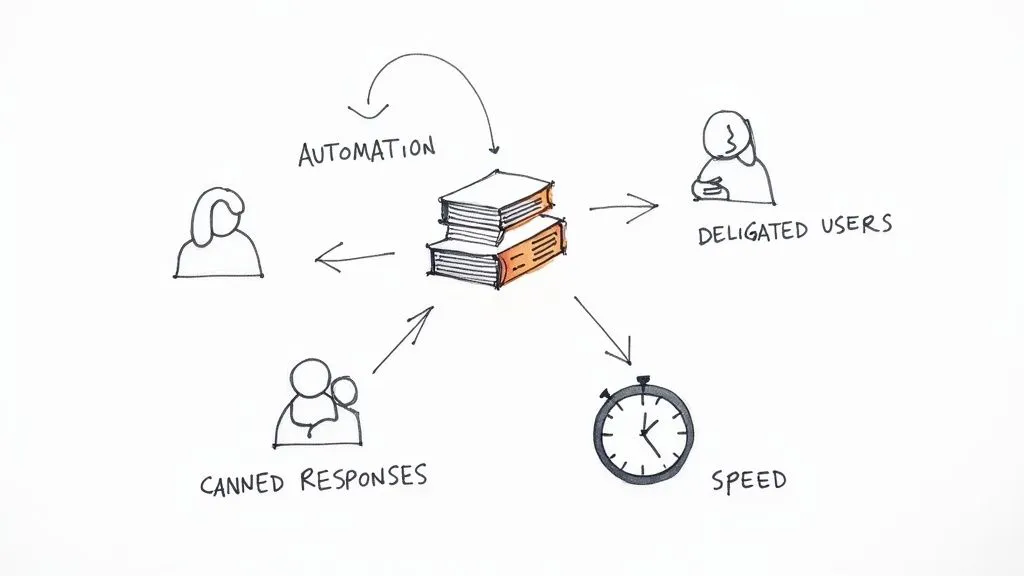

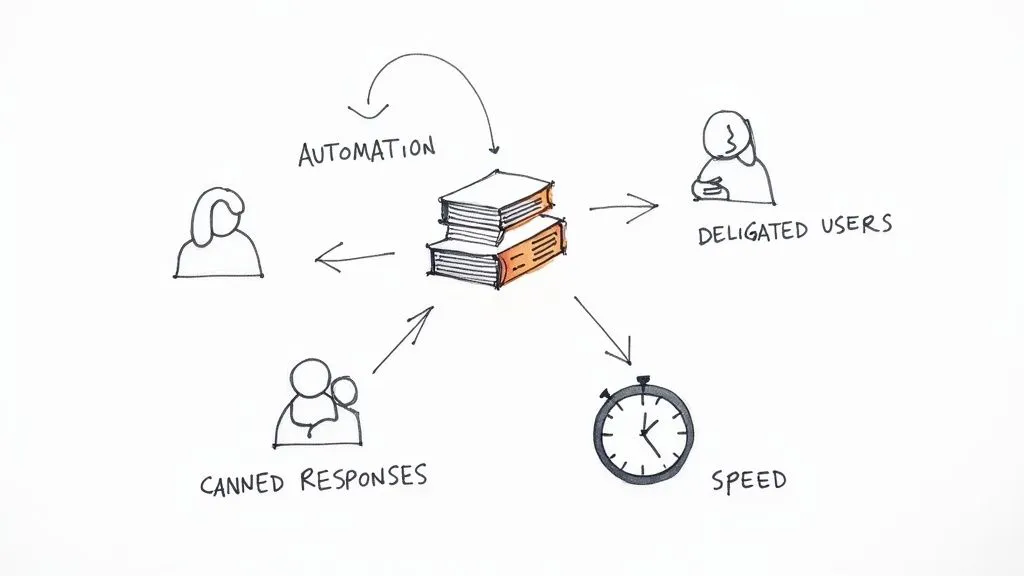

The Power of a Centralised Knowledge Library

At the heart of this shift is the knowledge library. Think of it as a single source of truth—one trusted, central hub for all pre-approved answers, policies, and supporting documents. Instead of starting from square one with every new questionnaire, your team can pull proven answers almost instantly.

This simple change brings three massive wins:

- Faster Responses: What used to take days or weeks can now be done in a fraction of the time.

- Improved Consistency: Every response is aligned with the company’s official, up-to-date messaging. No more rogue answers.

- Enhanced Accuracy: Answers are drawn from current, verified information, which dramatically cuts down on the risk of human error.

This isn’t just about convenience; it’s part of a much wider trend. The global due diligence market, already valued at USD 12.65 billion, is booming as firms in the UK and beyond adopt AI to slash investigation times by 30% to 40%. If you’re interested, you can read the full research on due diligence market trends and see the data for yourself.

Streamlining Collaboration and Automation

But modern platforms do more than just store information; they actively manage the entire workflow from start to finish.

These tools give teams the ability to automatically fill in known answers, route specific questions to the right subject-matter expert, and track progress in real-time. It turns a chaotic, manual task into a smooth and coordinated process.

The image below gives you a glimpse of how a tool like ResponseHub can suggest answers pulled directly from your own internal documents, even providing the source citation.

This level of automation frees your team to focus on the high-value work of verifying and refining answers, not just hunting for them. For any organisation that regularly faces in-depth security questions, exploring security questionnaire automation can be an absolute game-changer.

Common Questions About the DDQ Process Answered

Diving into the world of due diligence questionnaires can feel a bit overwhelming, and it’s natural for practical questions to pop up. It’s one thing to know the definition of a DDQ, but it’s another to understand how it actually works in the real world.

Let’s clear up a few of the most common points of confusion to help you navigate the process with more confidence.

What Is the Difference Between a DDQ and an RFP?

It’s easy to mix up a Due Diligence Questionnaire (DDQ) and a Request for Proposal (RFP), especially since you might encounter both during a single business deal. However, they serve completely different functions.

Think of it this way: An RFP is a sales pitch that asks, “How can you solve our problem and what will it cost?” A DDQ is more of an investigation, asking, “Are you a safe and reliable business for us to partner with?”

An RFP is all about procurement. You send it out to get competitive bids for a project, focusing on proposed solutions, capabilities, and pricing. A DDQ, on the other hand, is a risk assessment tool. It’s used to dig into a company’s financial health, legal history, and operational stability before you make a big commitment, like an investment or a merger.

How Long Does It Typically Take to Complete a DDQ?

This is a classic “how long is a piece of string?” question. The timeline for completing a DDQ can vary wildly. A straightforward vendor assessment might only take a few days to turn around.

At the other end of the spectrum, a complex DDQ for a major merger or acquisition could easily stretch into several weeks, or even months, requiring a huge coordinated effort from teams across the business.

Several factors will dictate the timeline:

- The complexity and sheer length of the questionnaire.

- How easily you can access the internal documents and data needed.

- The responsiveness of your subject-matter experts from different departments.

It’s worth noting that businesses using response management software often slash their completion times, simply because they can pull answers from a library of pre-approved content.

What Happens If You Provide Misleading Information in a DDQ?

Let’s be crystal clear: providing false or misleading information on a DDQ is a massive mistake with serious consequences. Honesty and accuracy are absolutely essential.

The fallout can be severe. We’re talking about immediate deal termination, potential lawsuits for misrepresentation or fraud, and hefty financial penalties. But beyond the legal and financial damage, it can completely destroy your company’s reputation, shattering trust with potential partners and the market as a whole.