· Jane Iamias · cycle of procurement · 21 min read

A Guide to the Cycle of Procurement in the UK

Master the UK cycle of procurement. This guide breaks down the key stages, common pitfalls, and success metrics for strategic sourcing and efficiency.

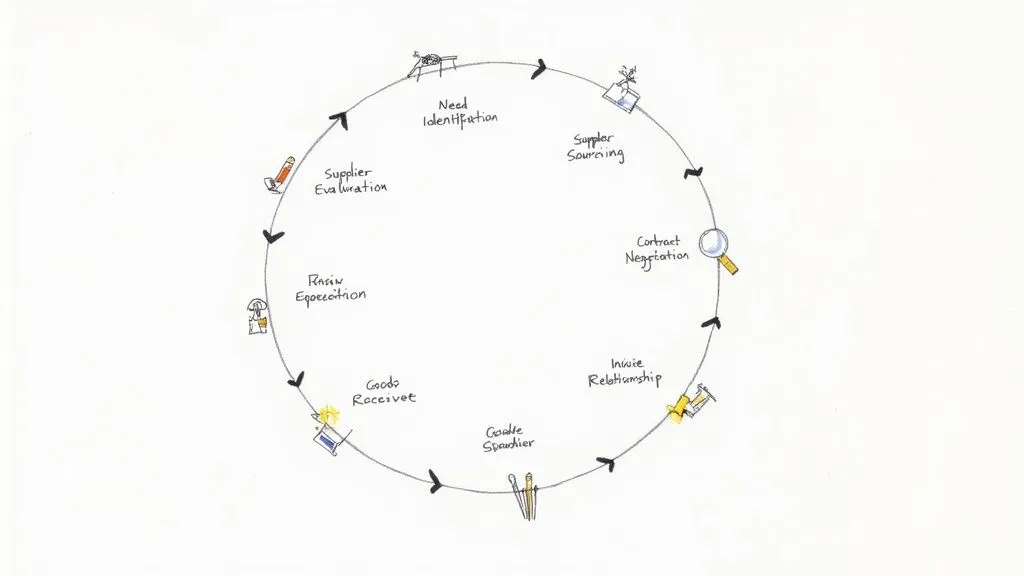

When we talk about the cycle of procurement, we’re not just talking about buying things. It’s the entire, end-to-end journey a company takes to get the goods and services it needs to operate. Think of it as a strategic loop that starts with realising you need something and doesn’t end until you’ve paid for it and are managing the relationship with the supplier. It’s all about getting the right value at the right time.

Unpacking The Procurement Cycle

A good way to picture the procurement cycle is to imagine you’re building a custom home. You wouldn’t just turn up with a pile of bricks and hope for the best. It all starts with a detailed blueprint (that’s your need identification). Next, you’d vet and choose the best builders for the job (sourcing suppliers), and then you’d hash out the details and sign a contract (contract negotiation). This structured process is what turns a simple purchase into a real strategic advantage.

A well-oiled procurement cycle is the engine that keeps a business running efficiently. It’s a continuous, repeatable process fine-tuned to keep risks low, control spending, and foster strong, dependable partnerships with suppliers. The cycle isn’t set in stone; it has to adapt to market shifts and the changing needs of the business, making it a truly dynamic and vital part of any organisation. For a closer look, you can learn more about the strategic role of procurement in business in our detailed guide.

Core Principles of The Procurement Cycle

The entire process is built on a few core principles that ensure it consistently delivers value:

- Value for Money: This is about more than just finding the cheapest option. It’s a careful balancing act between cost, quality, reliability, and service to get the absolute best outcome for the business.

- Risk Management: Having a structured cycle in place is brilliant for spotting and heading off potential problems, like supply chain breakdowns, shoddy quality, or compliance headaches.

- Efficiency and Speed: When you standardise the steps, your organisation can get what it needs much faster, which means fewer delays and operational hiccups.

- Transparency and Compliance: The cycle creates a clear, auditable paper trail. This ensures everything is fair, ethical, and in line with any relevant regulations.

To see how procurement fits into the bigger picture, it’s worth exploring the principles of effective international supply chain management. This wider view helps connect the dots between your procurement activities and global logistics, which is crucial for overall success.

Navigating The Modern UK Procurement Landscape

Here in the UK, the world of procurement is always on the move. A big change on the horizon is the full implementation of the UK Procurement Act in February 2025, which is set to introduce new transparency rules that will definitely shake up how the cycle is managed, especially in the public sector.

The Act is designed to bring more flexibility to tendering, allowing for multi-stage procurement that includes negotiation and dialogue. It’s a significant shift.

Ultimately, getting the procurement cycle right means moving away from just reacting and buying stuff, and towards a proactive, strategic approach to sourcing that genuinely supports your long-term business goals.

The Eight Core Stages of Procurement

It’s easy to think of procurement as one big, complicated task, but that’s a common trap. In reality, it’s a carefully choreographed dance of eight distinct, connected stages. Each step logically flows into the next, turning a simple business need into a powerful, long-term supplier relationship.

To bring this to life, let’s follow a real-world scenario. Imagine “FleetForward,” a national logistics company that needs to upgrade its delivery vans to meet new emissions standards. We’ll track how they navigate each stage of the cycle of procurement.

Stage 1: Need Identification

This is where it all begins—the spark. It’s the moment someone in the business realises there’s a gap between where they are and where they need to be. This isn’t just about wanting something new; it’s about nailing down exactly what’s required and, crucially, why.

For FleetForward, the need is glaring. Their vans are getting old, maintenance bills are climbing, and they won’t comply with upcoming environmental rules. The operations team gets together with finance and sustainability to formally document this problem.

This stage is all about:

- Defining the problem: Getting to the heart of the business challenge.

- Specifying requirements: Detailing the technical specs, performance criteria, and how many units are needed.

- Securing budget approval: Making sure the money is actually there.

Get this part wrong, and you’re setting yourself up for a world of pain later on. A poorly defined need is the number one cause of scope creep, blown budgets, and buying something that doesn’t even fix the original problem.

Stage 2: Supplier Sourcing

Once you know exactly what you need, the hunt for the right partner begins. This stage is about casting a wide, but smart, net to find vendors who can actually deliver on your requirements. It’s a research-heavy phase focused on building a solid list of potential candidates.

FleetForward’s procurement team dives in. They start researching commercial vehicle makers known for reliable, fuel-efficient vans. They’ll read industry journals, go to trade shows, and even ask other logistics firms for a steer in the right direction.

Key Takeaway: Sourcing isn’t about finding just any supplier; it’s about finding the right ones. Building a diverse and competitive pool of vendors is the secret to getting the best possible value.

The aim here is to go from a vague “everyone who sells vans” to a concrete longlist of suppliers you’ll invite to the next stage.

Stage 3: Supplier Evaluation and Selection

With your list of potential suppliers in hand, it’s time to dig deep. This is where you sort the contenders from the pretenders. Usually, this involves sending out formal documents like a Request for Information (RFI), Request for Proposal (RFP), or a Request for Quote (RFQ).

FleetForward sends a detailed RFP to six manufacturers. It asks for everything: pricing, vehicle specs, delivery timelines, warranty details, and information on their after-sales support. Using a structured RFP template can be a huge help in keeping this process organised and fair.

The evaluation itself is about more than just finding the cheapest option. You have to weigh up several factors:

- Technical capability: Can they actually build what you’ve asked for?

- Financial stability: Are they likely to be around in a year’s time?

- Past performance: What do their other clients say about them?

- Compliance and risk: Do they meet all legal, ethical, and security standards?

After carefully sifting through the responses, FleetForward narrows it down to the top three manufacturers for the final round.

Stage 4: Contract Negotiation and Award

This is where you hammer out the deal. Negotiation is a critical back-and-forth to finalise every term and condition, creating a partnership that works for everyone. And trust me, it’s about a lot more than just haggling over the price tag.

FleetForward’s team meets with each of the three shortlisted suppliers. They don’t just talk about the per-unit cost of the vans. They negotiate payment terms, delivery schedules, penalties for delays, and the fine print of the maintenance package.

A solid contract gives both sides clarity and protection. Once the terms are agreed upon with the winning supplier, the legal teams draft and sign the formal contract. This document is now the single source of truth for the entire relationship.

Stage 5: Purchase Order Creation

With a contract signed, you can start the actual buying process. A Purchase Order (PO) is a formal, legally binding document you send to the supplier to authorise a specific purchase.

Think of it like this: the contract governs the entire relationship, but the PO handles a single transaction. FleetForward issues a PO for the first batch of 50 vans.

The PO locks in the crucial details:

- A unique PO number for easy tracking

- The exact quantity and description of the items

- The agreed-upon prices

- Delivery address and required date

- Billing information

This creates a crystal-clear audit trail and stops any confusion about what was ordered.

Stage 6: Goods Receipt and Inspection

The moment of truth—when the delivery trucks pull up. This stage is more than just scribbling a signature on a delivery note. It requires a proper inspection to make sure the supplier has held up their end of the bargain.

When the first 50 vans arrive at FleetForward’s depot, the fleet managers give them a thorough check. They verify that the vehicles match the agreed-upon specs, are free from damage, and have all the right paperwork.

Any issues, like missing equipment or a scratch on the paintwork, are documented and flagged with the supplier immediately. This step is vital for quality control and ensures you only accept what you’ve actually paid for.

Stage 7: Invoice Processing and Payment

Once the goods are received and accepted, the supplier sends their invoice. This part of the process, often called “procure-to-pay” or P2P, is all about verifying the invoice and getting the supplier paid on time.

The best practice here is a three-way match. FleetForward’s accounts team compares three documents:

- The Purchase Order: What did we agree to buy?

- The Goods Receipt Note: What did we actually receive?

- The Supplier Invoice: What are they asking us to pay for?

If all three line up perfectly, the invoice is approved, and payment is sent according to the terms in the contract (for example, within 30 days). Getting this right is key to keeping your suppliers happy and avoiding late fees. For a deeper understanding of how these stages fit together, you can find valuable insights by exploring the complete process of procurement.

Stage 8: Supplier Relationship Management

The cycle of procurement doesn’t just stop when the bill is paid. The final stage is an ongoing effort to manage and nurture the relationship with your supplier to drive long-term value. This is how a good supplier evolves into a true strategic partner.

FleetForward sets up regular review meetings with the vehicle manufacturer. They track key performance indicators (KPIs) like on-time delivery stats, vehicle reliability reports, and how quickly the support team responds to issues.

This proactive approach helps them nip problems in the bud and spot opportunities to work together, like planning for future fleet needs. A strong supplier relationship can unlock better pricing, priority service, and even innovation—completing the loop and feeding valuable intelligence back into the very start of the next procurement cycle.

Modern Sourcing and Supplier Diversity in the UK

In the UK, the sourcing stage of the procurement lifecycle has really changed over the past few years, particularly in the public sector. Two big ideas are now at the forefront of every conversation: framework agreements and a serious push for supplier diversity. The goal is to make public spending smarter and fairer, but each approach comes with its own unique set of hurdles and rewards.

Framework agreements are now a standard feature of government procurement. Think of them as a pre-approved catalogue of suppliers that public bodies can use without needing to go through a massive, time-consuming tender process for every single purchase. This shift has become a central part of the modern cycle of procurement in the UK, driven by the need to speed things up, slash administrative overheads, and get better value for the taxpayer’s money. The data behind this trend is well-documented, showing a clear move towards these streamlined government supplier trends and insights.

But while these frameworks are fantastic for efficiency, they’re not without their downsides. By their very design, they can stifle competition for the entire length of the agreement, which might mean innovative new suppliers are left out in the cold until the framework comes up for renewal.

The Persistent Challenge of SME Engagement

Getting more public money into the hands of Small and Medium-sized Enterprises (SMEs) has been a headline goal for the UK government for years. The logic is sound: a more diverse supply chain fuels innovation, boosts the national economy, and builds resilience. Yet, despite the good intentions, SMEs often find themselves struggling to secure a meaningful share of public contracts.

The reasons are complicated. For many smaller businesses, the sheer complexity of bidding for large government contracts is a massive barrier. They often just don’t have the people or resources to handle the mountain of paperwork andtick all the compliance boxes. Framework agreements can sometimes make this even tougher, as just getting onto one of these coveted lists is a major undertaking in itself.

Key Insight: Supplier diversity isn’t just a box-ticking exercise or a social good. It’s a genuine strategic advantage. A supply chain that blends the scale of large corporations with the agility of SMEs is far more robust, innovative, and better prepared for whatever the market throws at it.

To stand a chance, SMEs need to prove they have their security and compliance house in order right from day one. This means doing your homework, a task made much easier when you have a solid process for vendor due diligence that helps you anticipate what your clients will demand.

Comparing SME Spend Across UK Government Sectors

The disparity in spending with SMEs is quite stark when you look across different government departments. Some sectors are leading the way, while others have a long way to go to meet the government’s ambitions.

| Government Sector | Percentage of Spend to SMEs | Absolute Spend with SMEs (£) |

|---|---|---|

| Department for Education | 28.5% | £2.1 billion |

| Ministry of Defence | 21.9% | £4.6 billion |

| Department of Health and Social Care | 22.4% | £4.3 billion |

| Home Office | 25.1% | £1.0 billion |

This data clearly shows that while billions are being spent with SMEs, the percentage of total spend often falls short of government targets, highlighting an ongoing challenge in turning policy into practice across the board.

Bridging the Gap for Smaller Suppliers

So, what’s the answer? How can organisations—both public and private—create a procurement process that’s genuinely inclusive? It all comes down to breaking down the barriers and actively making it easier for smaller players to get involved. This isn’t just charity; it opens up the buying organisation to a much richer pool of innovation and specialist expertise.

Here are a few practical steps that make a real difference:

- Simplifying Tenders: Instead of one giant contract, break it down into smaller, more manageable lots that smaller firms can realistically bid for.

- Improving Visibility: Use modern platforms and clear communication to ensure SMEs can actually find the opportunities relevant to them.

- Providing Clear Feedback: When a bidder is unsuccessful, offer them constructive feedback. It helps them learn and come back stronger next time.

- Streamlining Due Diligence: Make the security and compliance checks proportional to the contract’s size and risk. A £10k contract shouldn’t require the same level of scrutiny as a £10m one.

The ongoing conversation around this is captured perfectly in this snapshot from the British Chambers of Commerce, which discusses making new procurement laws work for small businesses.

This image underscores just how keen the business community is for procurement reforms to create real, tangible opportunities. It’s about moving from well-meaning policies to practical changes. Building a truly diverse supply chain means deliberately making the cycle of procurement more accessible, ensuring that the quest for efficiency doesn’t shut the door on fairness and market dynamism.

Common Mistakes in the Procurement Cycle to Avoid

Navigating the cycle of procurement feels a bit like captaining a ship on a long voyage. You can have the best map in the world, but that won’t stop you from hitting hidden reefs or sailing into a sudden storm. Having a well-defined process on paper is a fantastic start, but real-world success comes down to skilfully sidestepping the common pitfalls that can so easily sink your efforts.

Even the most carefully planned procurement process can get derailed by simple, avoidable errors. These blunders often seem small at first, but they can quickly spiral, leading to blown budgets, frustrating project delays, and soured supplier relationships. Knowing what these traps are is the first step toward building a procurement function that’s not just effective, but truly resilient.

Ignoring the Importance of Clear Specifications

One of the most frequent—and damaging—mistakes is failing to define what you actually need right at the very beginning. Vague or incomplete requirements are a recipe for disaster. It’s like asking a builder to construct a house without giving them a detailed blueprint; you’re almost guaranteed to get something you didn’t want, and it will cost a fortune to fix later.

This initial ambiguity almost always leads to scope creep, where the project’s goals expand uncontrollably as you go. Stakeholders start adding “just one more thing,” and before you know it, the original budget and timeline are a distant memory.

To get ahead of this, you have to invest serious time in the need identification stage.

- Collaborate across departments: Get everyone who will be affected by the purchase in a room together—from the end-users to the finance team—to create a truly comprehensive list of requirements.

- Distinguish “must-haves” from “nice-to-haves”: Prioritise features to give potential suppliers clarity and to keep your own evaluation focused on what really matters.

- Write it all down: Create a formal, detailed specification document that acts as the single source of truth for the entire project.

Conducting Insufficient Supplier Vetting

Choosing a supplier based purely on the lowest price is a classic procurement blunder. While cost is obviously a huge factor, a cheap bid from an unreliable or insecure partner can end up costing you far more in the long run. Skipping proper due diligence is like hiring a key employee after a five-minute chat—it’s a massive, unnecessary gamble.

This kind of oversight can open the door to a whole host of problems, from poor quality goods and missed deadlines to serious security breaches if the supplier is handling any of your sensitive data.

Key Takeaway: Your suppliers are an extension of your own organisation. Their failures in quality, reliability, or security have a direct impact on your business and your reputation. Proper vetting isn’t a box-ticking exercise; it’s a critical part of managing risk.

A robust vetting process should look at everything: a supplier’s financial stability, their track record, their technical capabilities, and, crucially, their security posture.

Neglecting Contract and Relationship Management

The procurement cycle doesn’t just stop once the contract is signed. In fact, that’s when the most important phase for creating long-term value really begins. Too many organisations make the mistake of filing the contract away and forgetting all about it, failing to actively manage the supplier relationship or monitor performance against the terms they fought so hard to agree.

This “sign and forget” approach means you miss out on opportunities for continuous improvement and, worse, you fail to hold suppliers accountable. Value slowly erodes as service levels slip, prices creep up, and contractual obligations are overlooked. Effective supplier relationship management (SRM), on the other hand, turns a simple transactional arrangement into a strategic partnership, making sure the value you negotiated is actually delivered for the entire life of the contract.

How to Measure Procurement Performance

Having a solid procurement cycle on paper is a great start, but how do you know if it’s actually delivering results? Just going through the motions isn’t enough. You need to measure your performance to see what’s working and what isn’t. This is where Key Performance Indicators (KPIs) come into play, turning your process into a measurable strategy that proves its value to the business.

Think of KPIs as the dashboard for your procurement engine. They give you the crucial data to see where things are running smoothly, identify any friction points, and spot opportunities for a tune-up. Without them, you’re flying blind. You can’t spot bottlenecks, justify spending, or show how procurement contributes directly to the bottom line.

Key Procurement KPIs You Should Track

Measuring performance isn’t about tracking every single number you can get your hands on. It’s about zeroing in on a handful of metrics that tell a clear story about cost, efficiency, and quality. A balanced approach ensures you’re not just chasing cost savings at the expense of everything else.

Here are some of the most impactful KPIs to monitor within your cycle of procurement:

Cost Savings and Avoidance: This is the most direct measure of your team’s financial impact. It tracks the real money saved through savvy negotiations (cost savings) as well as the estimated money saved by preventing future expenses (cost avoidance), like locking in a great price before a market increase.

Purchase Price Variance (PPV): This KPI shows the difference between the standard or budgeted cost for an item and what you actually paid. A positive variance means you’re buying smarter than planned, which is a direct boost to profit margins.

Purchase Order (PO) Cycle Time: How long does it take from the moment a purchase request is made to the official PO being sent to the supplier? A long cycle time can point to process bottlenecks, slow approvals, or clunky workflows that need a closer look.

Supplier Defect Rate: A vital quality metric. This KPI calculates the percentage of goods from a supplier that get rejected because they don’t meet your standards. A high defect rate is a huge red flag, signalling issues with a supplier’s quality control that can cause production delays and drive up costs.

Translating Metrics into Actionable Insights

Data is only useful if you know what to do with it. Each KPI offers a clue, helping you diagnose the health of your procurement operations and make smarter decisions that lead to genuine improvements.

For example, a consistently positive Purchase Price Variance is a clear win, proving your team’s negotiation skills are top-notch. On the flip side, if your PO Cycle Time starts to climb, it’s a warning sign. You can then dig in to find out if the delays are coming from requisition approvals, supplier communication, or something in your internal process.

The Goal of Measurement: Tracking procurement KPIs isn’t just about generating reports. It’s about turning raw data into a strategic roadmap that highlights successes, pinpoints weaknesses, and guides your team toward more efficient, value-driven outcomes.

By reviewing these metrics regularly, you can shift from being reactive to proactive. You’ll be able to spot underperforming suppliers before they become a major headache, fine-tune internal processes for greater speed, and clearly show how the procurement team adds strategic value well beyond just placing orders. This data-driven approach is the key to optimising the entire cycle of procurement.

Frequently Asked Questions

It’s one thing to understand the procurement cycle in theory, but making it work in the real world throws up a lot of practical questions. Let’s tackle some of the most common queries that pop up.

What Is the Difference Between Procurement and Purchasing?

It’s easy to use these terms interchangeably, but they represent two very different things. The distinction is actually quite simple.

Think of purchasing as a single, transactional step: placing an order, receiving the goods, and paying the invoice. It’s the ‘how’ of buying something.

The procurement cycle, however, is the entire strategic journey that comes before and after that purchase. It’s about identifying a need, finding and vetting the right suppliers, negotiating terms, and managing the ongoing relationship. Purchasing is just one small piece of the much larger procurement puzzle.

To put it another way, imagine you’re building a house. Purchasing is the act of buying the bricks and timber. Procurement is the whole project: drawing up the blueprints, choosing architects and builders, managing the construction, and making sure the final house is built to last.

How Can Small Businesses Engage in Public Sector Procurement?

For many small and medium-sized enterprises (SMEs), winning a public sector contract can feel like an impossible task. But it’s far more achievable than you might think if you approach it strategically.

The first step is to get on the radar. Register your business on the main government procurement portals so you can see what tenders are coming up. More importantly, get to grips with the compliance and security standards required for public contracts—these are often non-negotiable.

Here are a few tips to get you started:

- Start Small: Don’t go for the multimillion-pound contracts straight away. Look for smaller jobs or even opportunities to be a subcontractor for a bigger company. It’s a great way to build your reputation.

- Play to Your Strengths: Public sector bodies often need specialist skills that larger, more generic firms can’t offer. Pinpoint what makes you different and make that the core of your bid.

- Be Prepared: Have all your documentation—security policies, certifications, financial records—ready to go. The ability to respond quickly and professionally can set you apart from the competition.

How Is Technology Changing the Procurement Cycle?

Technology is completely changing the game in procurement. The manual, time-consuming tasks that used to bog teams down are now being automated, which frees up professionals to focus on what really matters: strategy, supplier relationships, and managing risk.

The biggest shift has come from e-procurement systems. These platforms bring the entire procurement cycle online, from creating a purchase order to paying an invoice. Everything becomes more efficient, transparent, and easier to audit.

Beyond that, AI is adding a whole new layer of intelligence. It’s moving beyond simple automation to proactively help teams. For instance, AI tools can now analyse spending data to flag potential savings or automatically scan contracts for risky clauses. We’re even seeing generative AI used to draft initial emails to suppliers. The next frontier is “Agentic AI”—smart systems that could one day run entire sourcing events on their own with minimal human oversight. This isn’t just about doing things faster; it’s about making smarter, data-driven decisions.